GNFZ enables compliance with EU sustainability regulations

This is Part One in a three-part series on EU sustainability regulations.

Part Two: How GNFZ certification helps compliance with EU Taxonomy, CSRD and CSDDD

Part Three: How GNFZ certification helps compliance with SFDR and EMAS

The European Union's main sustainability initiatives are led by the European Green Deal – a comprehensive package of policies aimed at making Europe the first climate-neutral continent by 2050. Key regulations under this framework focus on corporate reporting, finance, environmental standards, and circular economy principles. In this article, we dive deeper into some of these regulations and explore how the Global Network for Zero (GNFZ)‘s net zero certification enables compliance with these regulations.

What is EU Taxonomy?

The EU Taxonomy is one of the cornerstones of the European Union’s sustainable finance framework. Based on the EU Regulation (2020/852), the Taxonomy is law, not voluntary guidance. It sets Technical Screening Criteria (TSC) for activities across industries (energy, transport, construction, manufacturing, etc.).

The EU taxonomy allows financial and non-financial companies to share a common definition of economic activities that can be considered environmentally sustainable. Companies and financial institutions must disclose whether their activities are Taxonomy-eligible (fall within the scope) and Taxonomy-aligned (meet the criteria).

The EU Taxonomy covers six environmental objectives:

Climate change mitigation

Climate change adaptation

Sustainable use & protection of water and marine resources

Transition to a circular economy

Pollution prevention & control

Protection and restoration of biodiversity & ecosystems

For an activity to qualify towards EU Taxonomy, it must make a substantial contribution to at least one of the objectives listed above; Do No Significant Harm (DNSH) to the other five; and Comply with Minimum Safeguards (like OECD Guidelines, UN Guiding Principles on Business & Human Rights).

EU Taxonomy classifies environmentally sustainable economic activities and helps companies report “taxonomy-aligned” turnover or investments. EU Taxonomy matters because not only does it provide a standard classification of sustainable activities, but it also drives reporting through CSRD (Corporate Sustainability Reporting Directive), due diligence through CSDDD (Corporate Sustainability Due Diligence Directive), and access to finance through EU Sustainable Finance Disclosure Regulation (SFDR).

In addition, Eco-Management and Audit Scheme (EMAS, EU Regulation 1221/2009) is a voluntary environmental management tool. Though EMAS is not directly integrated with or explicitly required by the EU Taxonomy, the data collected, and procedures followed by EMAS-registered organizations can assist with mandatory reporting under the EU Taxonomy.

What is CSRD?

The Corporate Sustainability Reporting Directive (CSRD) requires companies to disclose how much of their turnover, capital expenses, and operating expenses is Taxonomy-aligned. The CSRD mandates that certain companies publish detailed sustainability reports, covering both how sustainability issues affect them (financial materiality) and the impact they have on society and the environment (impact materiality, or “double materiality”). This replaces the earlier Non-Financial Reporting Directive (NFRD), expanding scope and enhancing disclosure specificity using the European Sustainability Reporting Standards (ESRS). CSRD brings stringent, audited sustainability reporting in scope, phased in from 2024 to 2028.

For more details on CSRD, please refer our previously published article here.

What is CSDDD?

The Corporate Sustainability Due Diligence Directive (CSDDD) requires companies to implement due diligence and climate transition plans aligned with the Paris agreement, using Taxonomy alignment as part of the proof. The CSDDD (EU Directive 2024/1760) mandates robust human rights and environmental due diligence across value chains, phased in starting in 2027.

What is SFDR?

The Sustainable Finance Disclosure Regulation (SFDR) is a transparency framework for financial market participants (e.g., asset managers) that relies on the EU Taxonomy for disclosing the environmental sustainability of investments. It requires financial market participants and financial advisers in the EU to disclose sustainability risks, principal adverse impacts, and how their products align with sustainable investment objectives.

The SFDR requires financial firms to disclose how they consider Environmental, Social, and Governance (ESG) factors in their investment decisions. SFDR ensures financial institutions tell investors how sustainable their products really are. It’s intent is transparency & comparability in reporting.

The SFDR classifies investment products based on their sustainability focus:

Article 6 funds: Do not promote ESG characteristics and have minimal reporting requirements. They are required to disclose that their investments do not consider the EU Taxonomy criteria.

Article 8 funds ("light green"): Promote environmental or social characteristics. They must disclose if they invest in environmentally sustainable activities and, if so, their alignment with the EU Taxonomy's environmental objectives.

Article 9 funds ("dark green"): Have a sustainable investment objective. They face the most stringent requirements and must report their portfolio's specific alignment with the EU Taxonomy, including percentages based on metrics like turnover, capital expenditure (Capex), and operational expenditure (Opex).

What is EMAS?

The Eco-Management and Audit Scheme (EMAS) is a voluntary environmental management system that helps organizations improve and report on their environmental performance. EMAS requires organizations to implement an Environmental Management System (EMS), conduct audits, demonstrate continuous environmental improvement, and publish a verified environmental statement.

What is GNFZ net zero certification?

GNFZ Certification is a performance-based net zero certification of an organization’s GHG accounting, net zero commitments, and transition plans in alignment with global standards (ISO 14064, GHG Protocol, SBTi, etc.). GNFZ net zero certification ensures companies/ buildings can credibly claim net zero with independent third-party verification.

Based on the GHG Protocol, a global framework for measuring, managing and reducing emissions from private and public sector operations, value chains, products, cities and policies, GNFZ’s certification is rating system agnostic, aligns with the Paris Agreement and provides a path to calculate and eliminate Scope 1, 2 and 3 emissions. Built with total flexibility in mind, you can leverage the standard or framework of your choice to decarbonize and achieve certification.

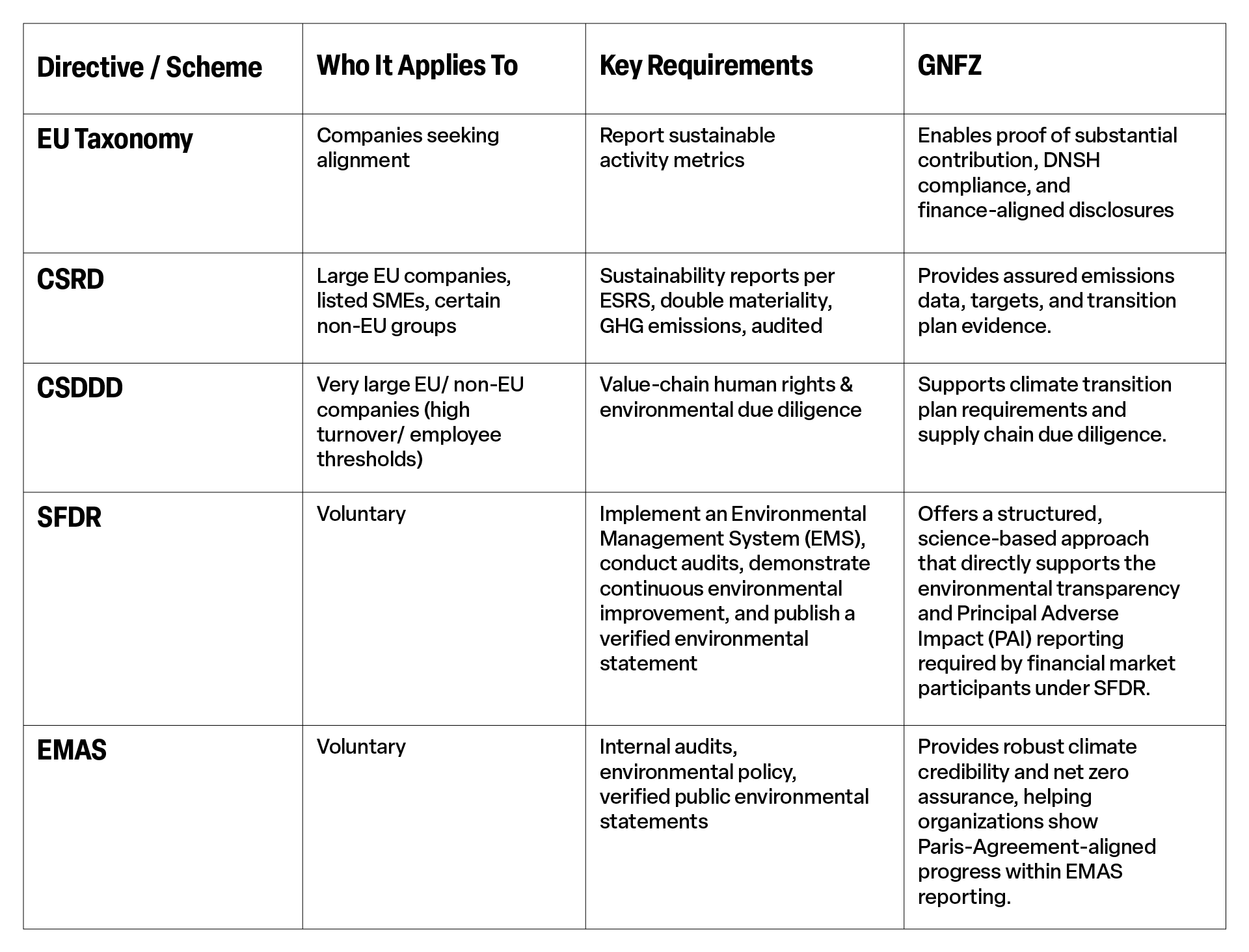

Achieving GNFZ net zero certification for your building, business or portfolio allows you to satisfy many of the requirements of the EU regulations we introduced above.

The following table summarizes how GNFZ supports each of the EU directives by fulfilling the key requirements. We go deeper the detailed connections in the part 2 and part 3 of this article series, as well as the impact of Omnibus package in this article.

Explore Part Two of this series to dive deeper into mandatory EU Taxonomy, CSRD and CSDDD, and Part 3, which focuses on the voluntary SFDR and EMAS.

Reach out to learn more about how GNFZ net zero certification can help with the EU regulations.